Inheriting a home in McAllen can feel overwhelming. Between navigating probate, sorting family responsibilities, and deciding whether to keep or sell the property, many Rio Grande Valley families don’t know where to start. This guide explains everything you need to know about Selling an Inherited House in McAllen: Probate Basics & Options, helping you move forward with confidence.

Understanding Inherited Property Challenges in McAllen

Inherited homes often come with:

- Deferred maintenance

- Property taxes owed

- Family disagreements

- Mortgage balances

- Probate confusion

McAllen residents frequently inherit homes from parents or grandparents who lived in the same home for decades, meaning repairs, updates, and paperwork may be needed before selling.

What Is Probate? Texas-Friendly Explanation

Probate is the legal process that allows the court to:

- Confirm the will (if one exists)

- Assign an executor or administrator

- Transfer the deceased person’s assets to the heirs

When Probate Is Required in McAllen

You need probate if:

- The deceased owned property solely in their name

- There is a will that needs validation

- There are debts or disputes

When Probate Can Sometimes Be Avoided

You may bypass probate if:

- The estate qualifies for a Small Estate Affidavit

- The property was held in a living trust

- The property was jointly owned with survivorship rights

Types of Probate in Texas (McAllen Guide)

Independent Administration

Most common in McAllen. Fast and inexpensive. Executors have broad authority.

Dependent Administration

Court-supervised. More paperwork, a slower process, and typically used during disputes.

Small Estate Affidavit

Used only when the estate is under $75,000 (excluding the home). Not always applicable for inherited houses.

Muniment of Title

The fastest method. Used when the will exists, no debts remain, and all heirs agree. No executor is appointed, the court order itself transfers the property.

Key Probate Documents to Expect

Letters Testamentary or Letters of Administration

– These documents give the executor legal power to sell the property.

Will Validation

– The court approves the will as legitimate.

Death Certificate

– Needed for title companies, insurance, and mortgage lenders.

Timeline: How Long Probate Takes in McAllen (2025)

Typical timeline:

- Muniment of Title: 30–45 days

- Independent Administration: 2–4 months

- Dependent Administration: 6–12 months

- Complicated estates: Up to 18 months

Selling the property cannot happen until the executor receives the legal authority to act.

Options for Selling an Inherited House in McAllen

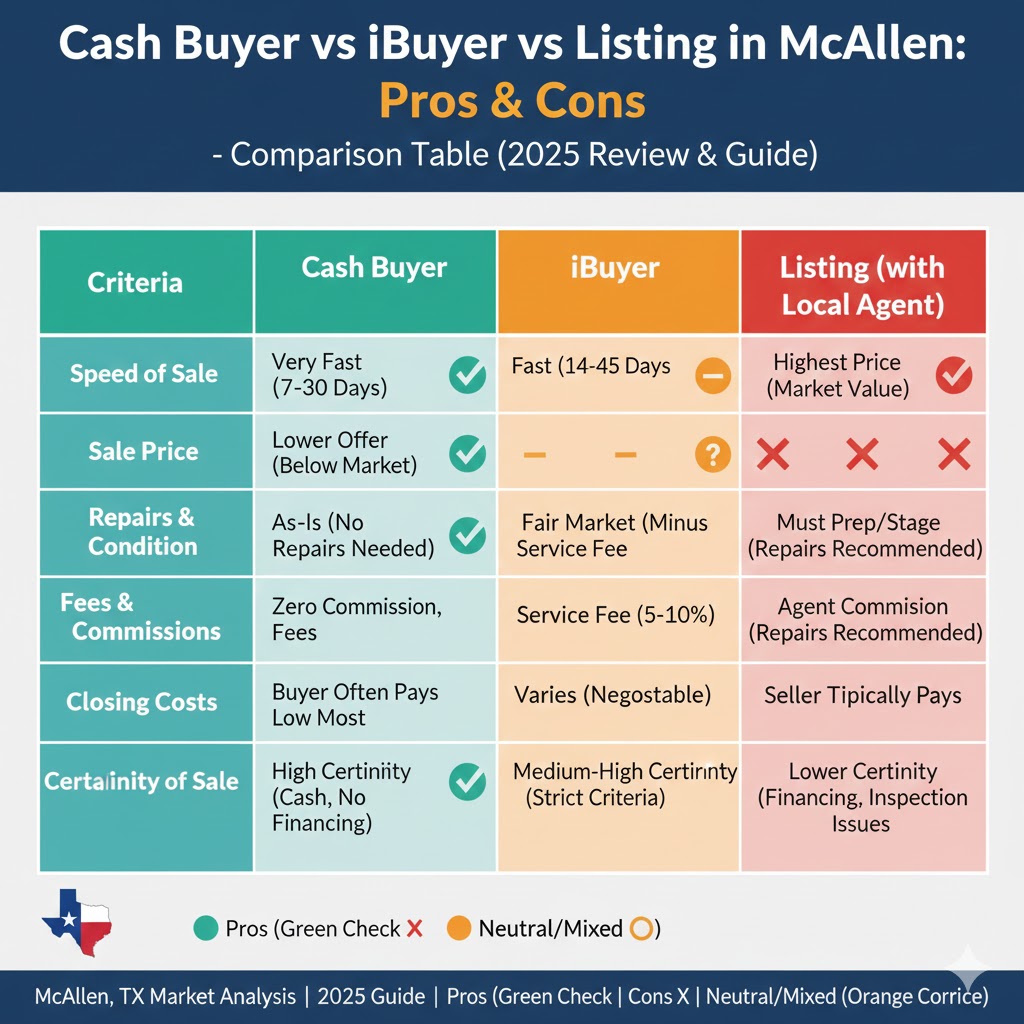

Option 1 – Sell As-Is to a Cash Buyer

Best for outdated or damaged homes.

Benefits:

- No repairs

- Fast closing

- Good for estate debts or taxes

- Avoids months of prep work

Option 2 – List with a Real Estate Agent

Best for well-maintained or updated homes.

Benefits:

- Highest sale price

- Large buyer pool

- Market exposure

Option 3 – Keep the Property as a Rental

Many McAllen heirs choose this.

Benefits:

- Long-term income

- Steady appreciation

- Good for family legacy

Option 4 – Transfer Ownership to an Heir

Used when one family member wants to live in the home.

Requires title updates and possibly refinancing.

Pros & Cons of Selling an Inherited House

Pros | Cons |

No long-term maintenance | Probate delays |

Avoid property taxes | Family disagreements |

Simplifies estate closure | Repairs may be needed |

Quick access to cash | Potential tax considerations |

McAllen-Specific Tax Considerations

Capital Gains Basics

You only pay capital gains tax on the profit made above the step-up value.

Step-Up in Basis Explained

Example:

If a McAllen home was bought for $70,000 but worth $220,000 at death, your taxable basis becomes $220,000, not the original price.

This often reduces or eliminates capital gains tax when selling.

Common Problems Heirs Face (And How to Solve Them)

Outdated Homes

Many inherited homes need updates.

Solution: Consider selling as-is to avoid repair costs.

Family Disputes

Conflicts delay probate.

Solution: Mediation or attorney-guided communication.

Mortgage or Liens

You can still sell, but they must be paid at closing.

Solution: Title company will handle payoff.

How to Prepare the Home for Sale

Documents Checklist

- Leters Testamentary / Administrationt

- Valid ID

- Death certificate

- Will (if available)

- Mortgage statements

- Property tax bill

- HOA information (if applicable)

FAQs About Selling an Inherited House in McAllen

Can I sell before probate is complete?

No, not legally. You must wait for the court’s authority.

Can multiple heirs sell the home together?

Yes. All heirs must sign closing documents unless one executor is empowered.

Does the house need repairs before selling?

Only if listing traditionally. Cash buyers purchase as-is.

What if the home still has belongings inside?

You can sell with contents included, or hire an estate cleanout service.

Do we owe property taxes during probate?

Yes. Taxes continue until paid at closing.

What if the mortgage is behind?

A sale can resolve delinquency, as long as it closes before foreclosure.

Conclusion

Understanding Selling an Inherited House in McAllen: Probate Basics & Options helps families make clear, confident decisions. Whether you choose to sell as-is, list with an agent, or keep the property, knowing the probate steps ensures a smoother process with fewer surprises.