Selling your Texas home for cash can be fast and convenient, but only if you’re working with a legitimate buyer. Unfortunately, fake cash buyers have increased across Texas, especially in Dallas–Fort Worth, San Antonio, Houston, Austin, and mid-sized cities like McAllen, Waco, and Lubbock.

This guide breaks down exactly How to Avoid Cash-Buyer Scams in Texas (Checklist) – Credibility booster, giving you practical ways to verify any buyer before signing a contract.

Why Cash-Buyer Scams Are Rising in Texas (2025 Overview)

Several factors have fueled the rise of scams:

- Increased investor activity

- More distressed properties and inherited homes

- Out-of-state buyers targeting Texas markets

- Fake “wholesalers” posing as investors

Because Texas is a non-disclosure state, scammers can exploit sellers who don’t know how to verify offers properly.

Understanding How Legit Texas Cash Buyers Operate

Legitimate Texas cash buyers:

- Provide written offers

- Show valid proof of funds

- Use licensed Texas title companies

- Communicate clearly

- Never pressure sellers

- Use official contracts (usually TREC contracts)

What a Real Cash Offer Includes

A legitimate Texas cash offer should include:

- Buyer’s full legal name

- Offer amount

- Earnest money details

- Title company information

- Closing date

- As-is condition terms

If any of these elements are missing, be cautious.

Warning Signs: How to Avoid Cash-Buyer Scams in Texas

Red Flag #1 - No Proof of Funds

Scammers often avoid showing bank statements or their funds come from unverifiable sources.

Red Flag #2 - Not Using a Title Company

Any buyer who wants to “handle the paperwork themselves” is a major warning sign.

Red Flag #3 - High-Pressure Tactics

Scammers push you to sign same-day contracts or threaten that the offer will “expire.”

Red Flag #4 - Earnest Money Under $100

Real investors deposit $250–$1,000+, depending on price. Low earnest money = low credibility.

The Ultimate Texas Seller Checklist (Credibility Booster)

Below is your complete credibility-boosting seller checklist for spotting safe buyers:

Step-by-Step Verification Checklist

- Ask for proof of funds (bank letter or statement).

- Verify they are using a legitimate Texas title company.

- Look up the title officer’s name and confirm the file exists.

- Request legally compliant contracts (preferably TREC).

- Ask for the buyer’s business name and address.

- Search their company on Google Business Profile.

- Look for online reviews, not just testimonials on their website.

- Check for LLC registration on the Texas SOS site.

- Confirm the buyer is not a “daisy-chain wholesaler” assigning contracts to others.

- Demand transparent timelines and closing details.

Questions Every Seller Must Ask

- “Will you close at a reputable Texas title company?”

- “Can you send proof of funds today?”

- “Is this your final offer, or will you assign the contract?”

- “How much earnest money will you deposit?”

If answers are vague, move on.

How to Verify a Cash Buyer’s Online Presence

A credible buyer should have:

- A traceable website

- Consistent branding

- A physical office location

- Verified social media pages

- Real Texas homeowner reviews

Fake buyers often have cheap, generic websites with stock photos and no legal information.

Title Company Confirmation: The Strongest Protection

The safest step is to call the title company directly.

Say:

“Hi, I want to verify that a file has been opened for my property and that this buyer is your customer.”

If they say there is no file, you’ve avoided a scam.

Real Examples of Cash Buyer Scams in Texas

These common situations happen every month:

- Fake wholesalers tying up properties and abandoning contracts

- Non-existent companies buying marketing lists and pretending to be investors

- Buyers creating urgency and then disappearing

- Identity spoofing, where scammers use reputable company names

With this guide, you’ll know exactly how to protect yourself.

Who Is Most at Risk of These Scams?

- Elderly homeowners

- Out-of-state sellers

- Inherited property owners

- Distressed or pre-foreclosure owners

- People needing fast closings

Education is the strongest defense.

How Legitimate Cash Buyers Boost Credibility

A professional Texas home-buying company will proudly share:

- Proof of recent purchases

- Title company references

- Business registration

- Licensed real estate professionals

- Industry memberships

- Real customer case studies

Good companies never hide their identity.

FAQs About Cash-Buyer Scams in Texas

How do I confirm a cash buyer is legit?

Verify proof of funds, call the title company, and review their online presence.

Should I ever sign a contract before checking documents?

No. Always verify the buyer first.

Why do some cash buyers offer very low earnest money?

Low earnest money indicates low commitment, or a possible scam.

Can I choose the title company?

Yes. Texas sellers have full right to choose.

Should I allow a cash buyer to bring their own “paperwork person”?

They’re more structured, but still require verification.

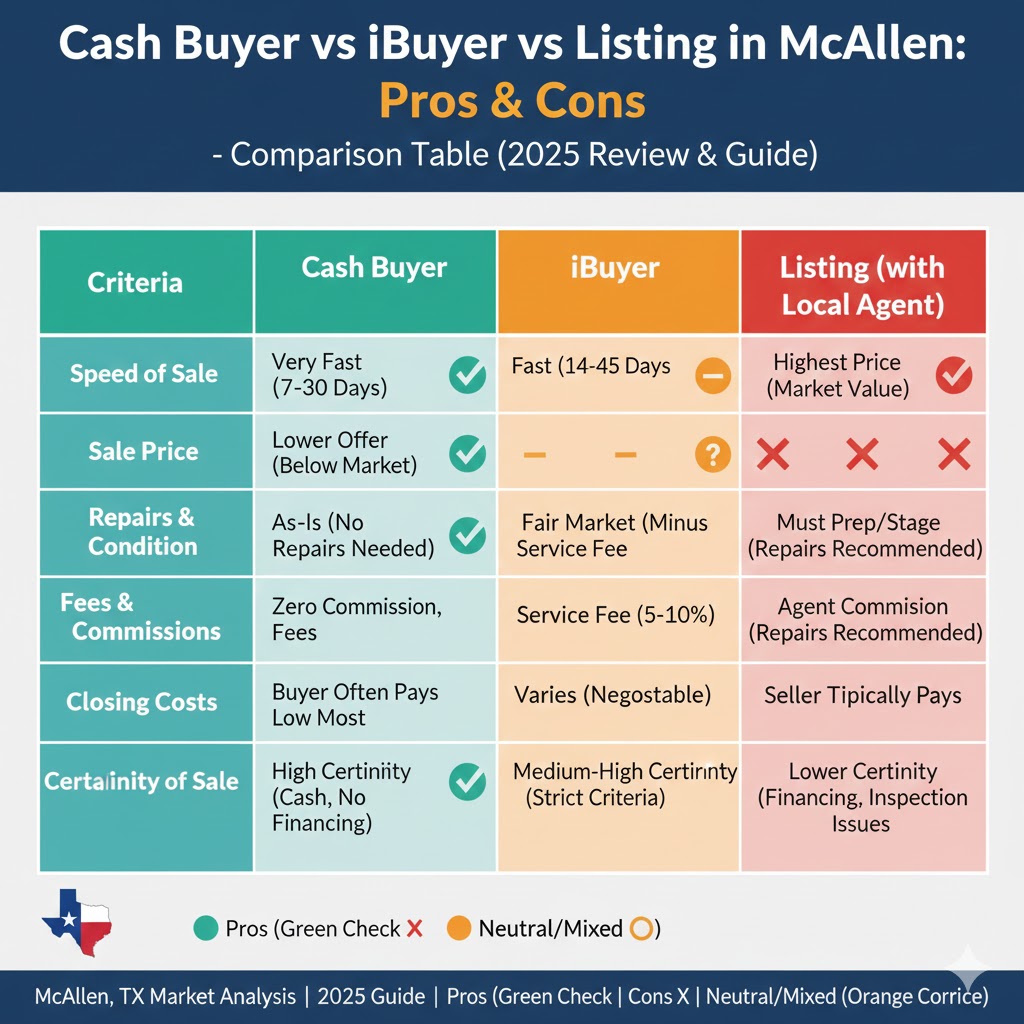

Are iBuyers safer than individual investors?

Yes. Sellers often select the title company to ensure safety and transparency.

Conclusion

Learning How to Avoid Cash-Buyer Scams in Texas (Checklist) – Credibility booster is the key to protecting your home, equity, and peace of mind. With the right steps, you can quickly separate legitimate Texas cash buyers from scammers and move forward confidently.